Executive summary

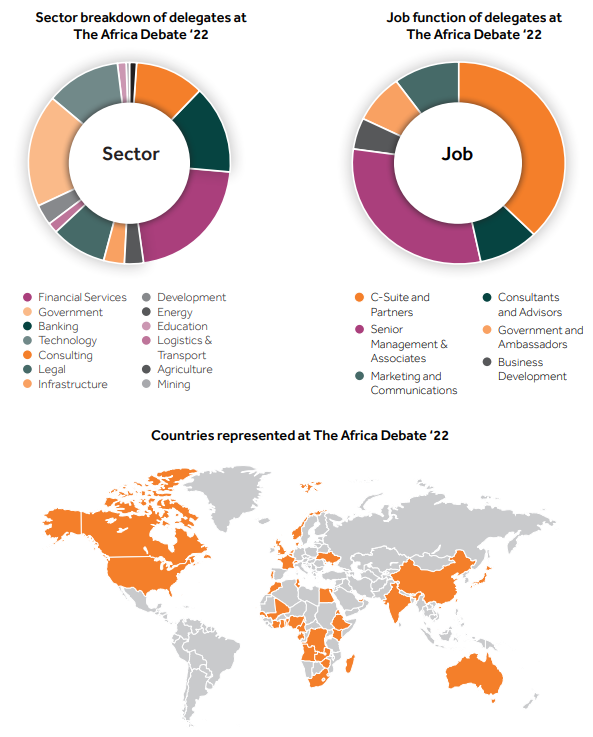

On 6th July Invest Africa hosted the 8th Africa Debate, in person at The Guildhall, London, assembling over 350 business and policy leaders from over 40 countries, to discuss the most pressing social and economic issues facing the African continent.

Summary of Points:

The combination of the pandemic and the Russia-Ukraine war has destabilised the geopolitical landscape. The global economy is facing extremely high levels of volatility defined by supply chain shocks and high inflation.

Given the continent’s heavy reliance on commodities and the depletion of public finances during the pandemic, Africa is vulnerable to external shocks and faces a challenging period over the short-term.

Over the longer-term, there are a series of global headwinds that could align in Africa’s favour including supply chain realignment, demand for natural resources, demographic trends, the push to invest in green solutions, and deepening regional integration.

The imperative to secure reliable supply chains in the wake of the pandemic and the war in Ukraine as well as the need to reduce emissions have resulted in an increasing push towards near-shoring of processing. As a leading supplier to natural resources, this could play in Africa’s favour if the continent can invest in its manufacturing and processing capacity.

Demographic growth is both Africa’s greatest strategic challenge as well as its greatest strategic opportunity. With a rapidly growing young population, Africa will represent one third of the global workforce by 2050. With sufficient investment in skills and job creation, Africa has the potential to become a global production hub.

Africa has a central role to play in the global race to net zero. The continent’s mineral reserves are essential to the rapid upscaling of renewable energy, while leveraging green investment into the continent will be critical to meeting net-zero targets as the region continues to expand energy access.

The continent’s leaders should go into negotiations at COP27 with a clear vision of Africa’s role and ensure that its resources are developed to create prosperity on the continent.

Businesses and investors continue to demonstrate support for the African Continental Free Trade Agreement and its ability to transform Africa’s economies from dependence on primary products to exports of value added goods. The implementation process still has a long road to run with further investments in infrastructure and financial services needed.

Filling Africa’s finance gap remains one the greatest challenges facing the continent against a particularly challenging macro-economic backdrop.

The financial services sector and development finance community should build partnerships to find financial models best adapted to Africa’s market profile. Expanding the use of multilateral guarantees, developing local pensions funds and deepening Africa’s capital markets could all aid in mobilising private capital in the region.

In contrast to the global trend towards fragmentation, Africa has demonstrated its commitment to regional unity through the challenges of the pandemic. Taking a continental approach will help the region renegotiate its role in the global economy, create more attractive markets and build resilience to external shocks.

At a Glance

Over 350 business leaders, investors and policy makers from over 40 countries joined The Africa Debate 2022 on the 6th July.

How can Africa Harness its Demographic Dividend?

Africa’s people are one of the continent’s greatest strengths, but without sufficient investment in skills, jobs and financial inclusion the continent’s rapidly growing population could undermine the region’s development. With a current median age of 19.7, Africa is the youngest continent globally and expected to be home to over 2 billion people by 2050, representing 1/3 of the global workforce. Harnessing the power of Africa’s youth is a regional and global priority with significant repercussions for economic growth, digital transformation, and global security.

“Africa will be home to 1/3 of the global workforce by 2050.”

For companies targeting long-term growth in the region, investing in skills is a must. According to Strive Masiyiwa, Founder of the telecoms giant Econet, “having young people is not enough, we have to have skilled young people”. In conversation with Invest Africa CEO, Karen Taylor, Masiyiwa emphasised the importance of investing in science and technology if Africa is to compete with the likes of China and India. This was echoed by Charles Murito, Director for Government Affairs and Public Policy in Sub-Saharan Africa for Google, who called on governments and businesses to invest in technical and vocational training as well as colleges and universities citing the Learning Lions programme in Kenya as an example of using remote learning to improve broad-based digital skills.

Participating businesses also highlighted the need to build more robust education systems from early years up through to adult learning. Where governments must lead the way in setting national curricula and investing in core education, there is plenty of scope for private companies to support life-long learning across the continent. 4G Capital for example is a neo-bank which provides training alongside micro-loans to business owners in the informal sector, filling the adult education gap with courses in record keeping, budgeting and client centrality. The company’s CEO, Wayne Hennessy-Barrett points to 4G Capital’s high repayment rates as evidence that this approach to continuous skills development creates wealth for the continent’s MSMEs. At a continental level, Afreximbank and the African Development Bank have demonstrated the importance of investing in a skills base for new growth sectors through partnerships with leading institutions in the creative sector with the leadership from both institutions emphasising the importance in those areas where Africa has a comparative advantage.

Just as important to capacity building as training and education itself is building an enabling environment that allows people to harness their skills to create wealth and jobs. To truly unlock growth at the scale Africa needs to outstrip its population explosion, Africa will need to take a continental approach focused on regional connectivity. For DHL’s Sub-Saharan Africa CEO, the key is unlocking the potential of Africa’s 44 million SMEs. “If we can get those SMEs to start trading beyond their borders and demystify that process, that will an enormous enhancement” he explains. This calls for a continental approach to unlock barriers to trade and transform the continent’s economies from exporting primary goods to trading value added products. According to Chinelo Anohu, Senior Director of the AfDB’s Africa Investment Forum, only by investing in manufacturing and processing will Africa successfully be able to transition from “from dependency to productivity”.

As the largest employer across the continent, developing Africa’s agricultural sector beyond subsistence farming to a stage where countries can begin to export agricultural goods will be key to developing a growth strategy that enhances people’s lives and creates jobs where they are needed. This is why Gary Vaughan-Smith, Chief Investment Officer of SilverStreet Capital, invests exclusively across the agricultural value chain with a focus on upskilling smallholder farmers. In sign of mounting appreciation of the importance of the sector, Mohammed Dewji, Founder and President of one of Tanzania’s largest companies, MeTL Group, stated that he sees agriculture as the key to unlocking Africa’s full potential and plans to make a $2 billion investment in the sector calling on regional leaders to focus on “growing our own food, feeding our own people, and exporting it to the world.”

Contact Us

For 2023 speaking and sponsorship enquiries:

For all other enquiries:

theafricadebate@investafrica.com

+44 (0) 20 3730 5035